For most travelers, the days of carrying travelers checks as a primary source of funding on vacation are long gone. Some may still use them as emergency backup, but most people these days have grown accustomed to the convenience of simply finding a bank machine in whatever city they find themselves in and pulling the local currency out from their account back home. Despite the rise in credit card and bank fees for these transactions, there’s still no beating using local ATMs when it comes to simple convenience.

The trouble is that thieves aren’t always as stupid as the ones on COPS, and some of them have cleverly designed what are referred to as “ATM skimmers” to swipe your card and bank information as you swipe your card. These skimmers are utilized by thieves all over the world, so it’s good idea to pay extra attention to that bank machine before you put your card in the slot.

What is an ATM card skimmer?

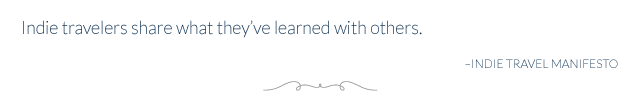

An ATM skimmer is a device that is placed over the slot where you’d insert your card into an existing bank machine (and, in some cases, other card readers like the ones at self-serve gas stations).

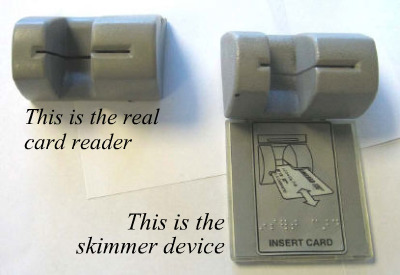

They’re designed to look exactly like the real machine they’re covering, and sometimes they’re even more detailed than the actual machine, so that the extra bits of plastic and metal can disguise more pieces of the skimmer.

How ATM skimmers work

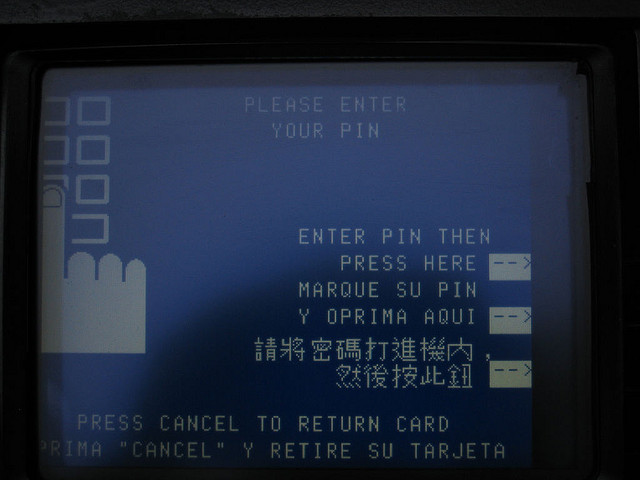

When you insert your debit or credit card into a cash machine, there’s a reader on the inside of the machine that interprets the information on your card’s magnetic strip, and that, coupled with the PIN you type into the keypad, gives you access to the money in your bank accounts.

[social]

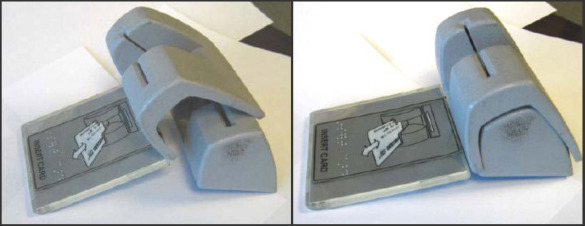

If you put your card into a bank machine that has a skimmer device on it, the ATM isn’t the only thing reading your card information – the skimmer also has a reader in it that records the information on your card’s magnetic strip. Without your PIN, however, even the information on the magnetic strip wouldn’t be enough for a thief to get at your account – which is why the second element of an ATM skimmer is a tiny pinhole somewhere over the keypad that hides a mini-camera. As soon as you insert your card into an ATM with a skimmer device, the camera is activated and it records your movements – and, therefore, your PIN.

Because ATM skimmers are placed over existing card slots on real and legitimate cash machines, you’re still able to go through your transaction as if nothing has happened. Or, in some cases, the screen will tell you there’s been a malfunction – but it will look like a normal error message from the bank. It’s only later that the information the skimmer gathered will be used to access your account.

How to spot ATM card skimmers

As mentioned, these thieves are clever – the skimmers they design take smarts and skill (which once again makes me wish they’d use their powers for good instead of evil, because who knows what problems they could solve?). It’s easy to mistake a bank machine that’s been tampered with for a perfectly safe place to withdraw money.

There are so many different kinds of bank machines that no one skimmer design works for all of them – which means there are many different kinds of skimmers, too. Some of them are, frankly, easier to spot than others. But here are some photos of an ATM skimmer discovered in California a few years ago.

For some examples of other kinds of ATM skimmers, see this article on Krebs on Security, this article on The Consumerist, and this article on Geek about criminals using 3D printing to make better skimmers.

How to protect yourself from ATM skimmers

The first thing to make sure of when you’re using an ATM – whether it’s the cash machine you use often at home or an unfamiliar machine you’re using while traveling – is that you’re paying closer attention than most people usually do to the machine itself. Does it look like there’s a piece of metal or plastic around the card reader that could easily come off if you pulled on it? Is there a pinhole in a piece of equipment right above the keypad?

While security experts say things like, “Most skimmers, key pad overlays, and cameras will be recognizable to the typical ATM user,” that’s not always true for travelers who are using bank machines that look different from the ones back home. This means that although you should still take an extra few seconds to look at the bank machine you’re thinking of using before you insert your card, the skimmer modifications may not be as obvious to you – making the other tips below even more important.

Whether or not you’re using a bank machine that’s familiar to you, it’s never a bad idea to somehow cover your hand as you’re typing your PIN into the keypad. As mentioned, it’s the combination of the information on your card’s magnetic strip and the PIN the camera records that gives the thieves complete access to your bank account, so without your PIN they’ll have a much bigger hurdle to climb over to get at your money. (And, frankly, if someone else isn’t taking the precaution of obscuring their PIN, that target is much more tempting because it requires less work.)

Using cash machines in very public areas can be a good way to avoid machines that are targets for skimmers in the first place, as they offer less opportunity for thieves to install and later remove the skimmers without being seen. In some countries, bank machines can be found inside grocery or convenience stores, and sometimes there are bank machines inside the banks to which they’re attached. When in doubt, these machines are a better bet simply because there’s always someone “watching” them.

Finally, even when you’re traveling it’s a good idea to check in with your bank account online every so often if you can. Since foreign transaction fees are so high these days, you’d be smart to withdraw money as few times as possible – withdrawing larger sums each time and stowing the excess cash in a money belt (you do have a money belt, right?). So a day or so after each transaction, if you can log into your account online to find out if anything other than your withdrawals are showing up, it may give you enough of a heads-up to stop any further theft.

And in any situation, if you have one of those “funny feelings” about a bank machine, don’t put your card in it – find another machine and use it instead.

Photo credits: Tax Credits, Salim Virji, photos of skimmer device provided by a police officer friend of the author