While there are certainly some downfalls to all the technology available to us today, it sure does help the long-term traveler, especially when it comes to staying on top of finances at home while off galavanting the globe.

But what are the best resources out there for round the world travelers? What’s the best way to stay on top of all your finances and pay those bills that still need to be paid while away?

Sign up for Mint

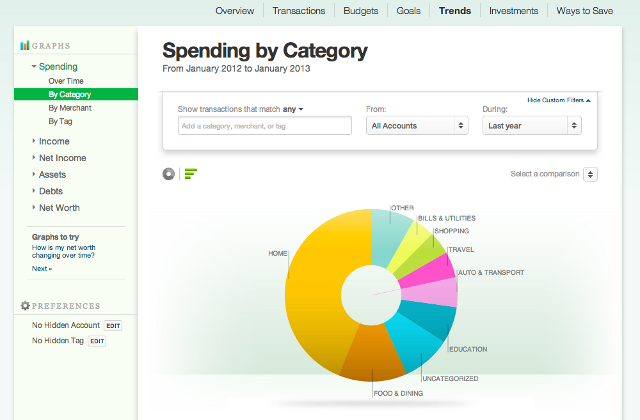

One of the top budgeting and finance sites I have found is Mint. It allows you to keep up with all of your finances in one place by registering any account you have – car payments, mortgage, credit cards, checking and savings accounts, student loans, etc., etc. You can sync any account you have with Mint, and they will organize and track everything.

This is great not only for budgeting reasons but also for keeping track of the bills you still have to pay while gone. Some will have more than others, but chances are you’ll still have to pay something while on the road. Mint alerts you to any bills that are due in the next month, and you can set up budgets for anything you like to make sure you are staying on track with your finances. It really is a fantastic tool for anyone who wants to keep better track of their money.

Student Loans

Many of us have those pesky student loans to worry about. It’s not terribly difficult to defer them if you aren’t going to have any money coming in while you’re on the road and simply don’t have the funds to keep paying them. This is a decision that everyone needs to make based on their own personal financial situation.

We decided to keep paying them while we were on the road. Yes, it did suck as between my wife and I we have a small mortgage of student loans to pay each month. But this was all part of our budget from the get-go, and we planned for the extra expense. Deferring is a nice, short term solution, and for some, it’s the only one. You have to do what’s best for you.

Automate everything

In this day and age, you can automate pretty much everything, which is a great idea for those heading off on long-term trips. While the internet is pretty much everywhere (you can get online after day one of the Inca Trail), there are going to be times when getting online is very difficult, if not impossible. Having the extra worry isn’t worth it, especially when it’s so easy to set up all your bills so they get paid automatically.

The key to this, of course, is making sure you have enough money in your account to make those payments. You need to come up with some financial plan. Some just have all their money in a checking account, so this would be a moot point. But for those who have their money spread out amongst different accounts, keep in mind that it often takes up to 5 business days to transfer funds while on the road and not near your bank, so having a plan in place is essential, especially for those times when you know you may be in the middle of nowhere without internet access.

Have a go-to person at home

Having someone at home who is your back-up financial person is something that everyone should try to set up. You may want to give that person access to your bank accounts should you need money moved around in a pinch.

If you own a home, this is even more important, especially if you are renting it out while gone. Come up with some kind of deal and do something really nice for that person, as it is a big responsibility, and it will be well worth it should something happen while you’re on the road.

If you automate the bill process as much as you can, you hopefully won’t need this person much, if at all, but it’s important to have someone in case of a “what-if” scenario.